📜Why OmniLending?

I. Background

Presently, a multitude of chains flourish simultaneously. Ethereum is the hub, housing over half of the total liquidity. The residual liquidity, however, is dispersed across various public chains.

The fragmentation of liquidity is clearly slowing asset turnover and making it harder for WEB3 users to manage their assets.

That’s why we need cross-chain, and then omnichain.

And in this article, we’d love to introduce our OmniLending, the first one to connect and unify all the on-chain liquidity and support omnichain lending functions developed by our team.

II. DOLA Protocol

The full name is “Decentralized Omnichain Liquidity Aggregation Protocol”

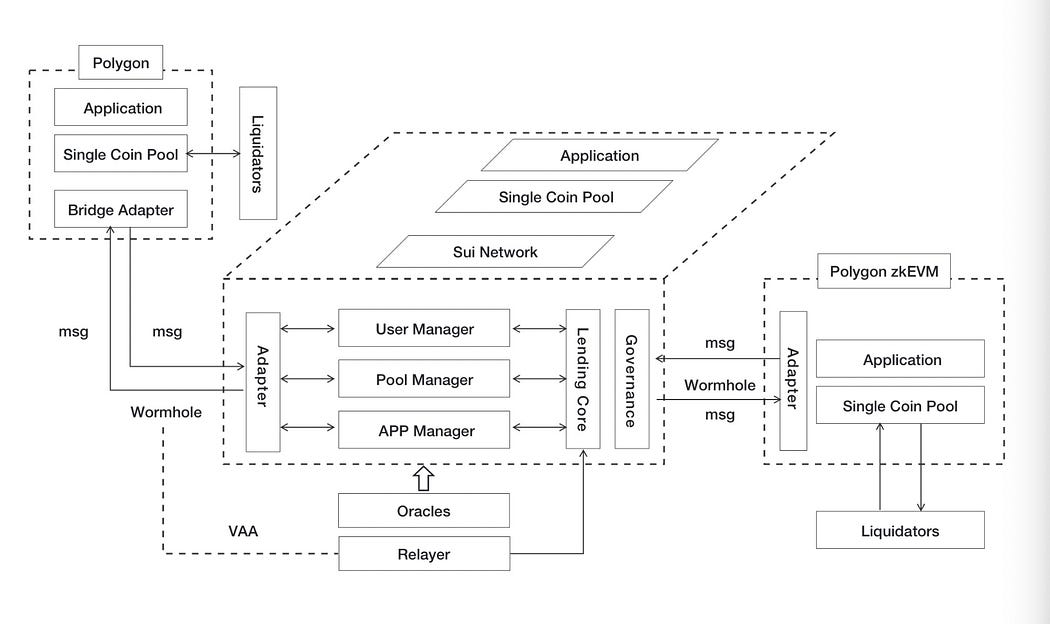

(1) Star Topology Structure: Since the Sui network confirms instantly, which reduces cross-chain time, brings a better user experience, easier-to-expand on-chain storage resources, and safer move contract features.

So we using Sui as the settlement center and other single-coin pools on the chain as branch nodes in our protocol to support that.

(2) Cross-chain of asset and message: Our protocol uses Layerzero, Wormhole, and other cross-chain message protocols to support cross-chain communication.

(3) On-chain Governance: In the early stage, the protocol will be charged by the team, but after the token is released, the team will gradually transition the power to decentralized governance, and finally it will completely go to the community.

(4) Extensible Application Plug-ins:

DOLA Protocol can be used to develop all kinds of omnichain products, like:

OmniID:omnichain digital identity, AA wallet entry

OmniLending

OmniSwap: Omnichain exchange

Omni-Stablecoin

OmniLSD: Omnichain liquidity mortgage derivatives

III. Omnilending

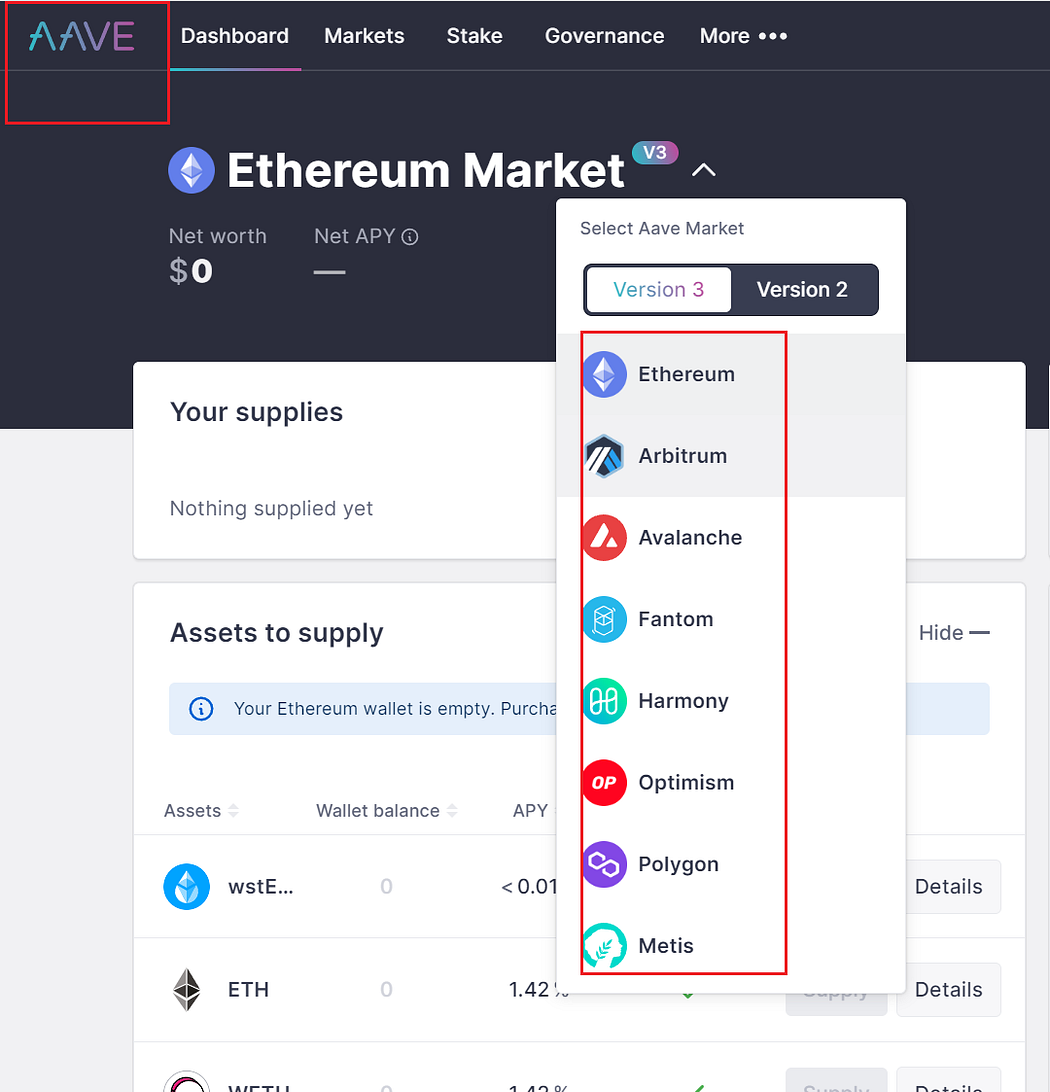

In this case, we regard Aave as a representative of lending protocols. It provides lending capabilities for a minority of tokens with better liquidity and satisfies the beneficial characteristics of no trust and no permission required.

Over time, it is proved that Aave’s lending service model operates very well, indicating a high feasibility of this type of service market.

However, Aave only satisfies the lending of assets with good liquidity, and it is not very effective for other assets with poorer liquidity. Furthermore, Aave operates in a single-chain mode, which means its ecosystem is relatively narrow.

If one wants to deploy its protocol on other public chains, the costs would be high, and the operation would be more complex for users.

Therefore, we believe that there are a lot of unmet needs in the current lending protocols, such as omnichain assets and a complete omnichain lending ecosystem, etc.

We launched our OmniLending based on the DOLA protocol to support:

(1) Decentralized lending pool: Users provide idle liquidity to earn returns, and borrowers pledge liquidity to take out loans.

(2) High asset utilization efficiency: Aggregate fragmented liquidity, enhancing the utilization of idle assets.

(3) Convenient management of multi-chain assets: Users can deposit to the protocol on chain A to earn returns, and withdraw to claim returns on chain B.

IV.OmniLending Protocol Security

Here’re some mechanisms we used to ensure our Lending protocol’s security:

(1) Over-collateralized: Every asset that is lent out corresponds to an over-collateralized asset, it’s the same as AAVE’s collateral ratio.

(2) Two-stage floating lending rates: Low rates encourage borrowing when funds are abundant and high rates encourage debt repayment and increase additional liquidity when funds are scarce.

(3) Risk Adjustment: Different from traditional lending protocol, we not only consider the risk of bad debts caused by the reduction of the value of the user’s collateral but also takes into account the risk of rising debt values.

(4) Soft liquidation: In traditional lending, the liquidator’s one-off liquidation debt is fixed at 0.5(at present), which means the liquidator allows the liquidator to liquidate half of the debt at one time. The downside of this approach is that if smaller liquidations can restore debt to health, then liquidating half the debt is excessive and unfair.

In a soft liquidation model, no more debt is allowed to be liquidated at any one time than is needed to bring the defaulter back to normal (plus an additional Factor of safety). This means that less than half of the debt is liquidated by borrowers who default lightly and more than half of those who default heavily.

(5) Anti-MEV Liquidation: In traditional lending, the incentive for liquidation is to offer the liquidator a fixed percentage discount on the borrower’s collateral, usually between 5% and 10%. Liquidators are profitable, but not MEV-resistant because miners can steal liquidators’ trades.

To limit this kind of MEV, the agreement allows a liquidity provider to qualify for a discount (a liquidation discount based on the liquidity contributed by the liquidator to the agreement), with a low or no discount for miners and others.

(6) Risk Margin: 20% interest on loans is used to pay off bad debts.

(7) Liquidity Sequestration: Users can choose to participate only in savings and not in lending, thus avoiding the impact of the liquidation of the asset pool.

(8) Joint Pricing: Combine decentralized Oracle and centralized exchange Price joint pricing.

(9) Multi-channel cross-link bridges: To improve the fault tolerance of cross-link bridges.

Last updated